How Augmented Surgical Robotics Will Transform Operating Rooms in 2025: Unveiling the Next Era of Precision, Efficiency, and Global Market Expansion. Explore the Technologies and Trends Shaping the Future of Surgery.

- Executive Summary: Key Insights and 2025 Outlook

- Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

- Core Technologies: AI, AR, and Robotics Integration in Surgery

- Leading Companies and Innovators: Profiles and Official Initiatives

- Clinical Applications: From Minimally Invasive to Complex Procedures

- Regulatory Landscape and Industry Standards

- Investment Trends and Funding Landscape

- Adoption Barriers and Enablers: Training, Cost, and Workflow Integration

- Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

- Future Outlook: Next-Gen Innovations and Strategic Roadmap

- Sources & References

Executive Summary: Key Insights and 2025 Outlook

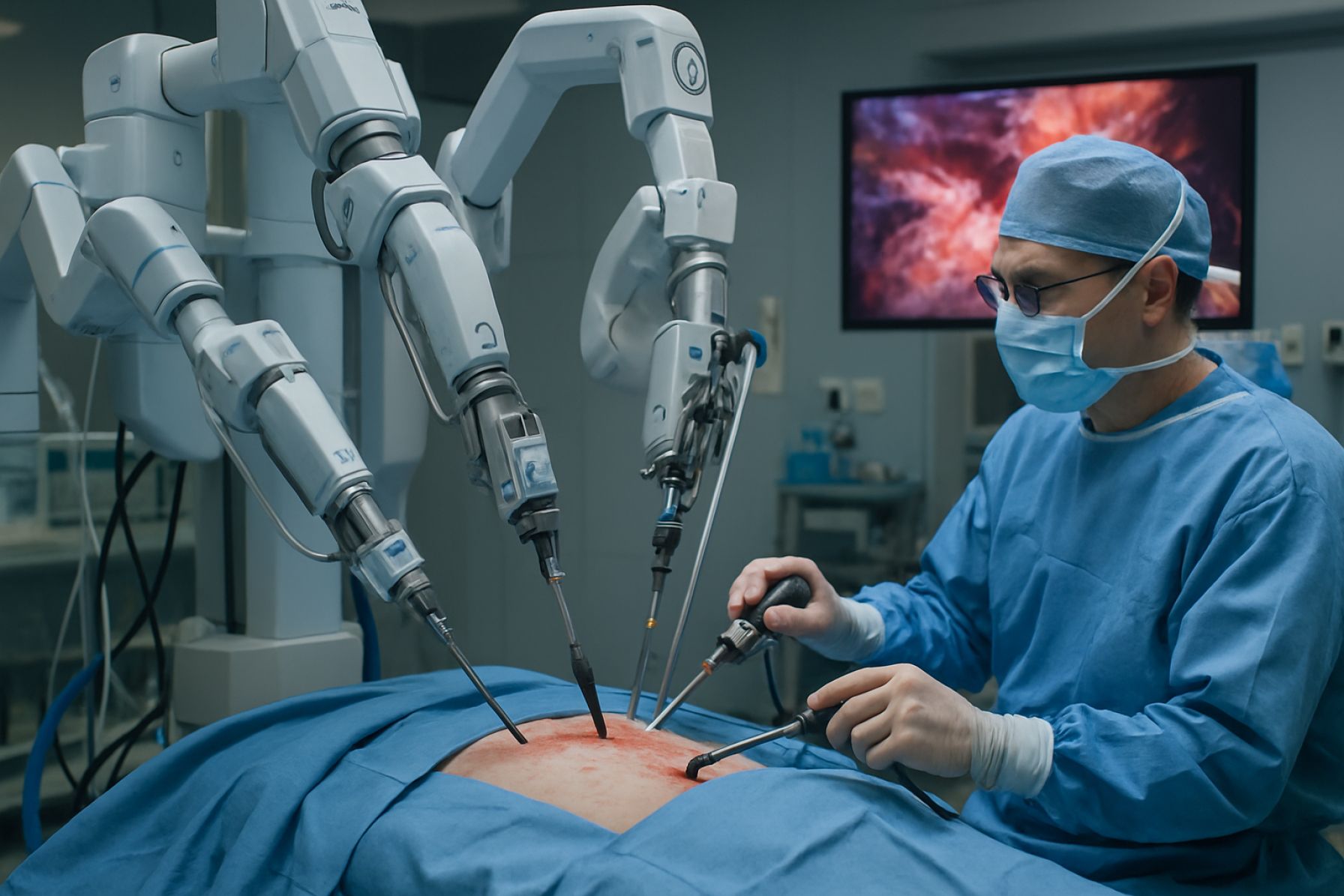

Augmented surgical robotics is poised for significant advancement in 2025, driven by rapid innovation, regulatory milestones, and expanding clinical adoption. The sector is characterized by the integration of advanced imaging, artificial intelligence (AI), and enhanced haptic feedback into robotic platforms, enabling greater precision, minimally invasive procedures, and improved patient outcomes. The global installed base of surgical robots continues to grow, with leading manufacturers reporting record procedure volumes and new system installations.

A dominant force in the field, Intuitive Surgical, maintains its leadership with the da Vinci platform, which surpassed 12 million cumulative procedures globally by early 2024. The company continues to expand its portfolio with next-generation systems and digital tools, focusing on real-time analytics and surgeon training. Meanwhile, Medtronic is accelerating the rollout of its Hugo™ robotic-assisted surgery system, targeting broader international markets and leveraging its global distribution network. Johnson & Johnson is advancing its Ottava™ platform, with clinical trials and regulatory submissions expected to intensify in 2025, aiming to challenge established players with modular, flexible architectures.

Emerging companies are also shaping the landscape. CMR Surgical has expanded the Versius® system’s footprint across Europe, Asia, and Latin America, emphasizing portability and cost-effectiveness. Smith+Nephew and Stryker are advancing orthopedic robotics, integrating augmented reality and AI-driven planning for joint replacement and trauma procedures. These developments are supported by collaborations with hospitals and academic centers to validate clinical efficacy and workflow integration.

Key trends for 2025 include the convergence of robotics with digital surgery ecosystems, such as cloud-based data management, telepresence, and remote proctoring. AI-powered decision support and intraoperative guidance are expected to become standard features, enhancing surgeon performance and reducing variability. Regulatory agencies in the US, EU, and Asia-Pacific are adapting frameworks to accommodate these innovations, with several new systems anticipated to receive market clearance in the next 12–24 months.

Looking ahead, the outlook for augmented surgical robotics is robust. Procedure volumes are projected to grow at double-digit rates, driven by expanded indications, increased hospital adoption, and ongoing improvements in usability and cost-effectiveness. Strategic partnerships, continued investment in R&D, and a focus on training and support will be critical to sustaining momentum and realizing the full potential of augmented surgical robotics in transforming surgical care.

Market Size and Growth Forecast (2025–2030): CAGR and Revenue Projections

The augmented surgical robotics market is poised for robust expansion between 2025 and 2030, driven by technological advancements, increasing adoption in hospitals, and a growing emphasis on minimally invasive procedures. As of 2025, the global market for surgical robotics—including systems enhanced by augmented reality (AR), artificial intelligence (AI), and advanced imaging—is estimated to be valued in the low tens of billions of US dollars. Leading industry participants such as Intuitive Surgical, Medtronic, Smith+Nephew, Stryker, and Johnson & Johnson (through its Ethicon and DePuy Synthes subsidiaries) are investing heavily in next-generation platforms that integrate real-time data, haptic feedback, and AR overlays to improve surgical precision and outcomes.

The compound annual growth rate (CAGR) for the augmented surgical robotics sector is widely projected to be in the range of 15% to 20% through 2030, outpacing the broader surgical robotics market due to the added value of augmentation technologies. For example, Intuitive Surgical—the maker of the da Vinci system—continues to report double-digit procedure growth and is expanding its portfolio with digital and AI-driven enhancements. Medtronic is scaling up its Hugo™ robotic-assisted surgery platform, which incorporates digital connectivity and data analytics, targeting both developed and emerging markets. Stryker’s Mako system, which leverages 3D modeling and AR for orthopedic procedures, is seeing increased adoption in North America, Europe, and Asia-Pacific.

Revenue projections for 2030 suggest the global augmented surgical robotics market could surpass $20–25 billion, with North America and Europe remaining the largest markets, but with significant growth expected in Asia-Pacific due to rising healthcare investments and infrastructure modernization. The expansion is further supported by regulatory approvals for new systems and indications, as well as partnerships between technology developers and healthcare providers. For instance, Smith+Nephew is advancing its CORI Surgical System, which integrates robotics with AR for knee and hip procedures, while Johnson & Johnson is developing the Ottava platform, aiming to bring greater automation and digital integration to the operating room.

Looking ahead, the market outlook remains highly positive, with continued innovation expected to drive adoption beyond large academic centers into community hospitals and ambulatory surgery centers. The convergence of robotics, AR, and AI is anticipated to further reduce procedure times, improve patient outcomes, and lower overall healthcare costs, solidifying augmented surgical robotics as a central pillar of future surgical care.

Core Technologies: AI, AR, and Robotics Integration in Surgery

Augmented surgical robotics is rapidly transforming the landscape of operative medicine, driven by the convergence of artificial intelligence (AI), augmented reality (AR), and advanced robotics. As of 2025, the sector is witnessing accelerated adoption and innovation, with several leading manufacturers and technology providers pushing the boundaries of what is possible in the operating room.

A central player in this field is Intuitive Surgical, whose da Vinci Surgical System remains the most widely deployed robotic platform globally. The company continues to enhance its systems with AI-powered analytics and real-time guidance, aiming to improve surgical precision and patient outcomes. In 2024, Intuitive Surgical reported over 10 million procedures performed worldwide using its systems, underscoring the scale and trust in robotic-assisted surgery.

Another significant contributor is Medtronic, which has expanded its Hugo™ robotic-assisted surgery (RAS) platform into new markets. Medtronic integrates AI-driven workflow optimization and data analytics, enabling surgeons to make more informed intraoperative decisions. The company’s focus on cloud connectivity and digital surgery platforms is expected to further streamline surgical workflows and training in the coming years.

Meanwhile, Smith+Nephew is advancing orthopedic and sports medicine robotics with its CORI Surgical System, which leverages real-time 3D mapping and AR overlays to assist surgeons in joint replacement procedures. The integration of AR allows for enhanced visualization of patient anatomy, improving implant alignment and reducing variability in outcomes.

In neurosurgery and spine, Globus Medical and Stryker are notable for their robotic navigation platforms. Globus Medical’s ExcelsiusGPS® system combines robotics, navigation, and intraoperative imaging, while Stryker’s Mako system utilizes AI algorithms for personalized surgical planning and execution, particularly in orthopedics.

Looking ahead, the next few years are expected to see deeper integration of AI and AR into surgical robotics. Real-time data fusion, predictive analytics, and remote collaboration capabilities are on the horizon, with companies like Verb Surgical (a collaboration between Johnson & Johnson and Verily) aiming to create fully connected, learning-enabled robotic ecosystems. These advancements are anticipated to democratize access to high-quality surgery, reduce learning curves for new surgeons, and enable minimally invasive procedures across a broader range of specialties.

Overall, the outlook for augmented surgical robotics in 2025 and beyond is marked by rapid technological convergence, expanding clinical indications, and a growing emphasis on data-driven, patient-specific care.

Leading Companies and Innovators: Profiles and Official Initiatives

The field of augmented surgical robotics is rapidly evolving, with several leading companies and innovators shaping the landscape through advanced platforms, strategic partnerships, and regulatory milestones. As of 2025, the sector is characterized by both established medical device giants and agile newcomers, each contributing to the integration of robotics, artificial intelligence (AI), and augmented reality (AR) into surgical practice.

Intuitive Surgical remains the global leader in robotic-assisted surgery, with its da Vinci Surgical System widely adopted in hospitals worldwide. The company continues to expand its portfolio, focusing on enhanced visualization, haptic feedback, and AI-driven analytics to support surgical decision-making. Intuitive’s ongoing investments in digital surgery and training platforms underscore its commitment to maintaining technological leadership (Intuitive Surgical).

Medtronic has made significant strides with its Hugo™ robotic-assisted surgery system, which is now being deployed in multiple regions. Medtronic’s approach emphasizes modularity, data integration, and cloud connectivity, aiming to democratize access to robotic surgery and enable real-time collaboration and analytics. The company’s partnerships with hospitals and research centers are accelerating the adoption of augmented features, such as AI-powered workflow optimization and remote proctoring (Medtronic).

Johnson & Johnson, through its Ethicon division and the Ottava™ platform, is advancing a next-generation robotic system designed for flexibility and seamless integration with digital surgery ecosystems. The company is leveraging its global scale and expertise in surgical instrumentation to develop systems that incorporate AR overlays and machine learning for enhanced precision and safety (Johnson & Johnson).

CMR Surgical, a UK-based innovator, has rapidly expanded the presence of its Versius surgical robotic system, focusing on versatility and ease of use. CMR’s open console design and cloud-based data analytics are enabling new models of surgical training and performance benchmarking, with a strong emphasis on accessibility for a broader range of healthcare settings (CMR Surgical).

Other notable players include Smith+Nephew, which is integrating robotics and AR in orthopedics, and Stryker, whose MAKO system is a leader in robotic joint replacement. Both companies are investing in AI-driven planning and intraoperative guidance.

Looking ahead, the next few years are expected to see increased regulatory clearances, broader clinical adoption, and deeper integration of AI and AR. Strategic collaborations between device manufacturers, software developers, and healthcare providers will likely accelerate the evolution of augmented surgical robotics, with a focus on improving patient outcomes, surgeon experience, and operational efficiency.

Clinical Applications: From Minimally Invasive to Complex Procedures

Augmented surgical robotics is rapidly transforming clinical practice, expanding from minimally invasive procedures to increasingly complex surgeries. As of 2025, robotic-assisted systems are being integrated into a broad spectrum of specialties, including general surgery, urology, gynecology, orthopedics, and cardiothoracic surgery. The most widely adopted platforms, such as the da Vinci Surgical System from Intuitive Surgical, have performed millions of procedures worldwide, with ongoing enhancements in visualization, dexterity, and data integration.

Recent years have seen a surge in next-generation systems that leverage advanced imaging, artificial intelligence (AI), and real-time data analytics to augment surgeon capabilities. For example, Medtronic has introduced the Hugo™ robotic-assisted surgery (RAS) system, which is designed for multi-quadrant procedures and features modularity and cloud-connected analytics. Similarly, Johnson & Johnson is advancing its Ottava™ platform, aiming for greater flexibility and integration with digital surgery ecosystems.

Clinical applications are expanding beyond traditional laparoscopic interventions. In orthopedics, Stryker’s Mako system enables highly precise joint replacements, using preoperative planning and intraoperative guidance to improve outcomes. In neurosurgery and spine, Globus Medical and Zimmer Biomet offer robotic platforms that assist with navigation and implant placement, reducing variability and enhancing safety.

Data from recent multicenter studies and registries indicate that robotic-assisted procedures can lead to reduced complication rates, shorter hospital stays, and faster recovery compared to conventional techniques, particularly in high-volume centers. For instance, robotic prostatectomy and hysterectomy have become standard of care in many institutions, with ongoing trials evaluating their role in more complex oncologic and reconstructive surgeries.

Looking ahead, the next few years are expected to bring further integration of AI-driven decision support, augmented reality overlays, and remote collaboration tools. Companies such as SI-BONE and CMR Surgical are developing systems tailored for specific anatomical regions and ambulatory settings, broadening access to advanced surgical care. As regulatory approvals expand and cost barriers decrease, augmented surgical robotics is poised to become a mainstay across a wider range of clinical applications, from routine minimally invasive procedures to the most complex surgical interventions.

Regulatory Landscape and Industry Standards

The regulatory landscape for augmented surgical robotics is rapidly evolving as these systems become increasingly integrated into operating rooms worldwide. In 2025, regulatory agencies are intensifying their focus on ensuring the safety, efficacy, and interoperability of robotic-assisted surgical platforms, particularly those enhanced with augmented reality (AR), artificial intelligence (AI), and advanced data analytics.

The U.S. Food and Drug Administration (FDA) continues to play a pivotal role in shaping the approval process for surgical robots. The FDA’s Center for Devices and Radiological Health (CDRH) has established specific pathways for premarket notification (510(k)) and premarket approval (PMA) for robotic surgical systems, with additional guidance for devices incorporating AI and machine learning. In 2024 and 2025, the FDA has signaled a move toward more rigorous post-market surveillance and real-world evidence requirements, especially for systems that leverage continuous software updates and cloud-based analytics.

In Europe, the MedTech Europe association and the European Medicines Agency (EMA) are working within the framework of the Medical Device Regulation (MDR 2017/745), which became fully applicable in 2021. The MDR imposes stricter requirements for clinical evaluation, traceability, and post-market monitoring of surgical robots, including those with AR and AI components. Manufacturers such as Intuitive Surgical—the developer of the da Vinci system—and Smith+Nephew, with its CORI Surgical System, are actively engaging with European notified bodies to ensure compliance with these evolving standards.

Industry standards are also being shaped by organizations such as the Association for the Advancement of Medical Instrumentation (AAMI) and the International Organization for Standardization (ISO). These bodies are developing and updating standards for software lifecycle processes (e.g., IEC 62304), risk management (ISO 14971), and interoperability (IEEE 11073 series), which are increasingly relevant as surgical robots become more connected and data-driven.

Looking ahead, the next few years are expected to see the introduction of harmonized global standards for cybersecurity, data privacy, and human-machine interface design in surgical robotics. Companies such as Medtronic and Stryker are investing in regulatory science and collaborating with standards bodies to anticipate future requirements, particularly as AI-driven decision support and AR visualization become standard features. The regulatory environment in 2025 and beyond will likely demand greater transparency, robust clinical validation, and continuous post-market oversight, shaping the pace and direction of innovation in augmented surgical robotics.

Investment Trends and Funding Landscape

The investment landscape for augmented surgical robotics in 2025 is characterized by robust funding activity, strategic acquisitions, and a growing influx of capital from both established medtech giants and venture capital firms. The sector’s momentum is driven by the convergence of advanced robotics, artificial intelligence, and real-time imaging, which collectively promise to enhance surgical precision and patient outcomes.

Major industry players continue to dominate funding headlines. Intuitive Surgical, the pioneer behind the da Vinci Surgical System, maintains its leadership through sustained R&D investment and strategic partnerships. In 2024, Intuitive Surgical reported allocating over $700 million to research and development, with a significant portion directed toward next-generation robotic platforms and augmented reality integration. Similarly, Medtronic has accelerated its capital deployment in surgical robotics, particularly following the global rollout of its Hugo™ robotic-assisted surgery system. Medtronic’s ongoing investments are aimed at expanding system capabilities and global market reach.

Emerging companies are also attracting significant venture capital. CMR Surgical, known for its Versius robotic system, completed a major funding round in late 2024, raising over $165 million to support international expansion and product development. The company’s focus on modular, cost-effective robotic solutions has resonated with investors seeking scalable technologies for diverse healthcare settings. Meanwhile, Smith+Nephew continues to invest in its CORI Surgical System, targeting orthopedics and leveraging AI-driven planning tools.

Strategic acquisitions are shaping the competitive landscape. In early 2025, Johnson & Johnson reaffirmed its commitment to digital surgery by advancing its Ottava robotic platform, following the integration of Auris Health and Verb Surgical technologies. This consolidation of expertise and intellectual property is expected to accelerate innovation cycles and attract further investment.

Looking ahead, the funding environment is expected to remain dynamic. The increasing adoption of value-based care models and the demand for minimally invasive procedures are likely to sustain investor interest. Additionally, regulatory milestones—such as expanded FDA clearances for new robotic systems—will play a pivotal role in unlocking further capital inflows. As competition intensifies, both established and emerging players are anticipated to pursue aggressive funding strategies to secure technological leadership and global market share in augmented surgical robotics.

Adoption Barriers and Enablers: Training, Cost, and Workflow Integration

The adoption of augmented surgical robotics in 2025 is shaped by a complex interplay of barriers and enablers, particularly in the domains of clinician training, cost structures, and workflow integration. As leading manufacturers and healthcare providers push the boundaries of robotic-assisted surgery, these factors are central to the pace and breadth of adoption.

Training remains a critical enabler and barrier. The sophistication of systems such as the Intuitive Surgical da Vinci platform and Medtronic Hugo™ robotic-assisted surgery system necessitates comprehensive training programs for surgeons and operating room staff. In 2025, companies are increasingly investing in simulation-based education, remote proctoring, and digital curricula to accelerate proficiency. For example, Intuitive Surgical has expanded its global training centers and virtual learning modules, while Medtronic integrates real-time analytics and feedback into its training ecosystem. Despite these advances, the learning curve for complex procedures and the need for ongoing credentialing remain significant hurdles, especially in resource-limited settings.

Cost is another major determinant. The initial capital outlay for robotic systems, which can exceed $1 million per unit, along with recurring expenses for maintenance and disposable instruments, poses a substantial barrier for many hospitals. Intuitive Surgical and Medtronic are responding with flexible financing models, including leasing and pay-per-use arrangements, to broaden access. Additionally, new entrants such as CMR Surgical with its Versius system are promoting modular, cost-efficient platforms aimed at smaller hospitals and ambulatory centers. Nevertheless, the return on investment is closely scrutinized, with administrators weighing the potential for reduced complications and shorter hospital stays against the high upfront and ongoing costs.

- Workflow integration is a further challenge. Robotic systems must be seamlessly incorporated into existing surgical suites, information systems, and perioperative protocols. Companies like Smith+Nephew are focusing on compact, mobile designs and interoperable software to minimize disruption. Integration with hospital electronic health records and imaging platforms is also advancing, but variability in infrastructure and staff familiarity can slow adoption.

Looking ahead, the outlook for augmented surgical robotics adoption is cautiously optimistic. As training technologies mature, costs are contained through competition and innovation, and workflow integration becomes more streamlined, broader uptake is expected—particularly in high-volume centers and specialized surgical fields. However, addressing disparities in access and ensuring robust clinical evidence will remain priorities for stakeholders in the coming years.

Regional Analysis: North America, Europe, Asia-Pacific, and Emerging Markets

The global landscape for augmented surgical robotics is rapidly evolving, with North America, Europe, Asia-Pacific, and emerging markets each demonstrating distinct trajectories in adoption, innovation, and regulatory progress as of 2025 and looking ahead. These regions are shaped by varying healthcare infrastructures, investment climates, and regulatory frameworks, influencing the pace and nature of robotic surgery integration.

North America remains the leading region in augmented surgical robotics, driven by robust investment, advanced healthcare systems, and a strong presence of pioneering companies. Intuitive Surgical, headquartered in California, continues to dominate with its da Vinci platform, which has surpassed 12 million procedures globally and is widely adopted across U.S. hospitals. The region also benefits from the presence of Medtronic, which is expanding its Hugo™ robotic-assisted surgery system, and Johnson & Johnson, advancing its Ottava platform. Regulatory support from the U.S. Food and Drug Administration (FDA) has facilitated the introduction of new systems and indications, with ongoing clinical trials and approvals expected to accelerate through 2025 and beyond.

Europe is characterized by a diverse regulatory environment and strong public healthcare systems, fostering both established and emerging players. CMR Surgical (UK) has made significant inroads with its Versius system, now installed in over 20 countries, including major European markets. The European Union’s Medical Device Regulation (MDR) is shaping the approval process, with a focus on safety and efficacy. Germany, France, and the UK are leading in adoption, supported by government initiatives to digitize healthcare and address surgical workforce shortages. Partnerships between hospitals and technology providers are expected to intensify, driving further market penetration.

Asia-Pacific is witnessing the fastest growth, propelled by rising healthcare expenditure, expanding private hospital networks, and government support for medical innovation. In China, TINAVI Medical Technologies is advancing locally developed robotic systems, while Japan’s OMRON Corporation and South Korea’s Koh Young Technology are investing in surgical robotics R&D. The region’s large patient base and increasing demand for minimally invasive procedures are expected to drive double-digit growth rates through the next several years, with local manufacturers gaining ground alongside global leaders.

Emerging markets in Latin America, the Middle East, and Africa are at earlier stages of adoption but show significant potential. Efforts are focused on improving healthcare infrastructure and training, with pilot programs and public-private partnerships introducing robotic systems in major urban centers. As costs decrease and technology becomes more accessible, these regions are projected to see accelerated uptake, particularly in tertiary care and teaching hospitals.

Overall, the outlook for augmented surgical robotics is robust across all regions, with North America and Europe leading in innovation and adoption, Asia-Pacific experiencing rapid expansion, and emerging markets poised for future growth as barriers to entry diminish.

Future Outlook: Next-Gen Innovations and Strategic Roadmap

The landscape of augmented surgical robotics is poised for significant transformation in 2025 and the ensuing years, driven by rapid advancements in artificial intelligence (AI), machine vision, and human-machine interface technologies. Leading manufacturers are intensifying their focus on integrating real-time data analytics, enhanced haptic feedback, and cloud connectivity to improve surgical precision, workflow efficiency, and patient outcomes.

A key player, Intuitive Surgical, continues to expand the capabilities of its da Vinci platform, emphasizing augmented reality (AR) overlays and AI-powered guidance systems. The company’s ongoing development roadmap includes more autonomous functions and advanced imaging integration, aiming to reduce surgeon fatigue and further minimize invasiveness. Similarly, Medtronic is advancing its Hugo™ robotic-assisted surgery system, with a focus on modularity and interoperability with hospital digital ecosystems. Medtronic’s strategic partnerships are expected to accelerate the adoption of cloud-based analytics and remote collaboration features, which are anticipated to become standard in the next generation of surgical robots.

In Europe and Asia, CMR Surgical and Titan Medical are pushing the boundaries of compact, versatile robotic platforms. CMR’s Versius system is being enhanced with AI-driven workflow optimization and improved ergonomic controls, targeting broader accessibility in both high- and low-resource settings. Titan Medical, meanwhile, is developing single-port robotic systems with advanced visualization and instrument dexterity, aiming to address unmet needs in minimally invasive surgery.

The next few years will also see a surge in collaborative robotics, where robots and surgeons work in tandem, leveraging real-time data from intraoperative imaging and patient-specific models. Companies such as Smith+Nephew are investing in navigation and robotics platforms that integrate with preoperative planning tools and intraoperative sensors, enabling more personalized and adaptive procedures.

Regulatory bodies are responding to these innovations by updating frameworks to accommodate AI-driven decision support and remote operation capabilities. The convergence of robotics, AI, and digital health is expected to drive double-digit growth in the sector, with a strategic emphasis on interoperability, cybersecurity, and surgeon training. As these technologies mature, the outlook for augmented surgical robotics in 2025 and beyond is one of accelerated adoption, broader clinical indications, and a shift toward more intelligent, connected, and patient-centric surgical care.

Sources & References

- Intuitive Surgical

- Medtronic

- Smith+Nephew

- Globus Medical

- Zimmer Biomet

- SI-BONE

- Association for the Advancement of Medical Instrumentation

- International Organization for Standardization

- TINAVI Medical Technologies

- Koh Young Technology

- Titan Medical