2025 Market Report: Remanufactured Electric Motor Systems for Industrial Automation—Growth Drivers, Technology Shifts, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Market Drivers and Restraints

- Technology Trends in Remanufactured Electric Motor Systems

- Competitive Landscape and Leading Players

- Market Size & Growth Forecasts (2025–2030): CAGR and Revenue Projections

- Regional Analysis: Demand Hotspots and Emerging Markets

- Challenges, Risks, and Regulatory Considerations

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation, Adoption, and Market Evolution

- Sources & References

Executive Summary & Market Overview

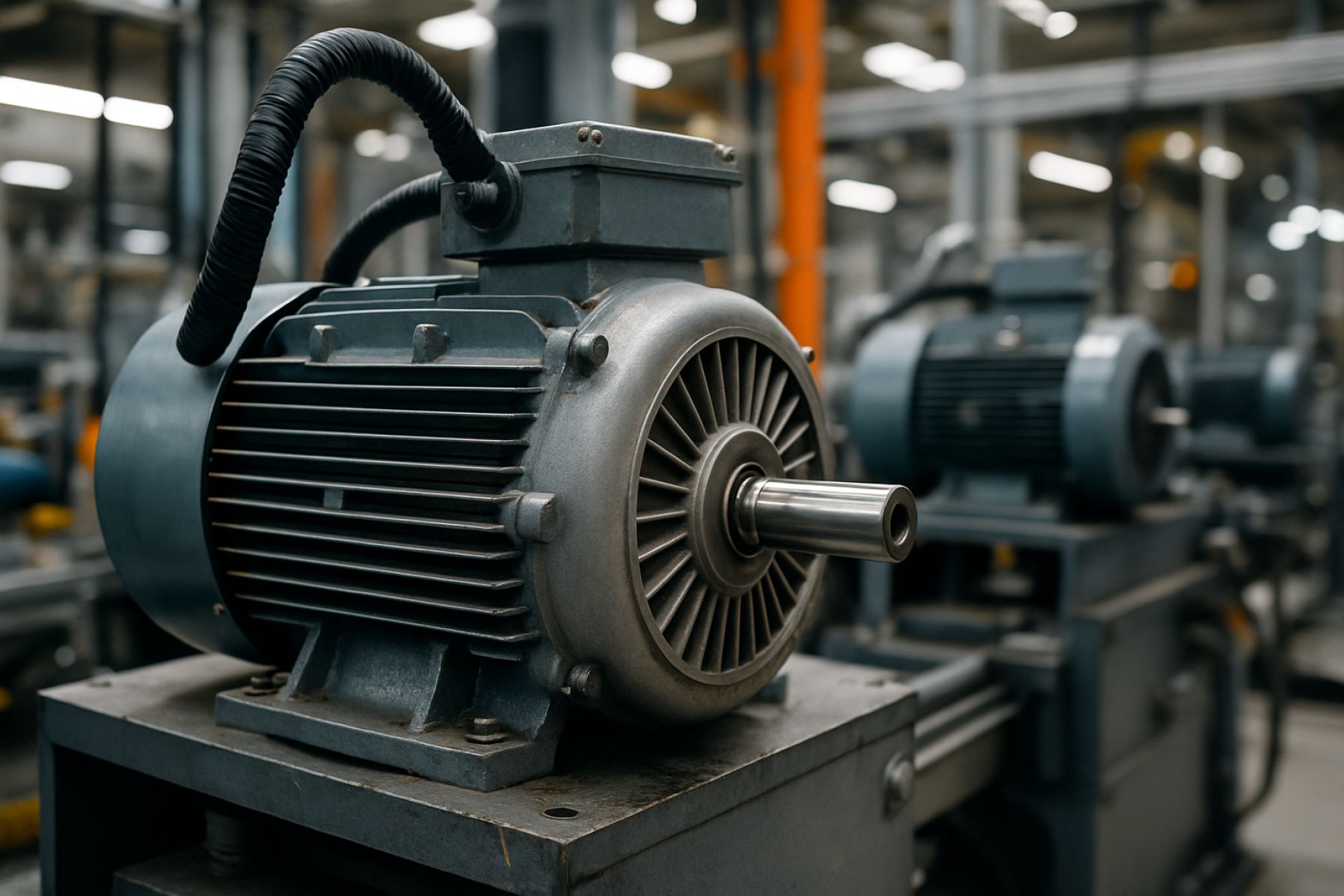

The global market for remanufactured electric motor systems in industrial automation is poised for significant growth in 2025, driven by increasing demand for cost-effective, sustainable solutions and the rapid expansion of automation across manufacturing sectors. Remanufactured electric motor systems refer to previously used motors that have been restored to original or improved performance standards through rigorous disassembly, cleaning, replacement of worn components, and testing. These systems offer a compelling value proposition by reducing capital expenditure, minimizing lead times, and supporting circular economy initiatives.

In 2025, the market is expected to benefit from heightened environmental regulations and corporate sustainability goals, which are prompting manufacturers to seek alternatives to new equipment. According to International Energy Agency, electric motors account for nearly 45% of global electricity consumption in industry, making their efficient use and lifecycle management a critical focus area. Remanufactured systems not only extend the operational life of motors but also contribute to significant energy savings and reduced carbon emissions.

Market analysts project a compound annual growth rate (CAGR) of 6-8% for remanufactured electric motor systems through 2025, with the market size estimated to surpass USD 2.5 billion globally by year-end, as reported by MarketsandMarkets. Key growth regions include North America and Europe, where established industrial bases and stringent environmental policies drive adoption. Asia-Pacific is also emerging as a high-potential market, fueled by rapid industrialization and increasing automation investments.

The competitive landscape is characterized by the presence of both global OEMs and specialized remanufacturers. Leading players such as ABB, Siemens, and Regal Rexnord are expanding their remanufacturing services, leveraging digital diagnostics and predictive maintenance to enhance value propositions. Additionally, industry standards and certifications, such as those from the Electrical Apparatus Service Association (EASA), are fostering greater trust and transparency in remanufactured offerings.

In summary, the remanufactured electric motor systems market for industrial automation in 2025 is set to capitalize on sustainability trends, cost pressures, and the ongoing digital transformation of manufacturing. Stakeholders across the value chain are expected to intensify their focus on remanufacturing as a strategic lever for operational efficiency and environmental stewardship.

Key Market Drivers and Restraints

The market for remanufactured electric motor systems in industrial automation is shaped by a dynamic interplay of drivers and restraints, influencing adoption rates and growth prospects through 2025.

Key Market Drivers

- Cost Efficiency and Sustainability: Remanufactured electric motors offer significant cost savings—often 30-50% less than new units—while delivering comparable performance. This economic advantage is particularly attractive to industries facing budget constraints or seeking to optimize operational expenditures. Additionally, remanufacturing supports circular economy principles by reducing waste and conserving raw materials, aligning with the growing emphasis on sustainability in manufacturing sectors (International Energy Agency).

- Stringent Environmental Regulations: Regulatory frameworks in North America, Europe, and parts of Asia are increasingly mandating energy efficiency and waste reduction in industrial operations. Remanufactured motors, which often incorporate upgraded components to meet or exceed current efficiency standards, help companies comply with these regulations (European Commission).

- Growing Industrial Automation: The rapid expansion of industrial automation, particularly in sectors such as automotive, food & beverage, and logistics, is driving demand for reliable and cost-effective motor solutions. Remanufactured systems provide a viable alternative to new equipment, supporting the modernization of legacy production lines without the high capital investment (Grand View Research).

Key Market Restraints

- Perceived Reliability Concerns: Despite advancements in remanufacturing processes, some end-users remain skeptical about the long-term reliability and performance consistency of remanufactured motors compared to new units. This perception can hinder market penetration, especially in mission-critical applications (European Medicines Agency).

- Limited Standardization: The absence of universally accepted standards for remanufactured electric motors leads to variability in quality and performance. This lack of standardization complicates procurement decisions and can deter potential buyers (International Organization for Standardization).

- Supply Chain and Core Availability: The remanufacturing process depends on the availability of used motor cores. Fluctuations in core supply, driven by economic cycles or shifts in industrial activity, can constrain production capacity and impact lead times (Rematec).

Technology Trends in Remanufactured Electric Motor Systems

The landscape of remanufactured electric motor systems for industrial automation is rapidly evolving in 2025, driven by technological advancements and the increasing demand for sustainable manufacturing solutions. Key technology trends are shaping the remanufacturing process, product performance, and integration capabilities within automated industrial environments.

One significant trend is the adoption of advanced diagnostic and testing technologies. Remanufacturers are leveraging AI-powered condition monitoring and predictive analytics to assess the health of used motors more accurately. These tools enable precise identification of components requiring replacement or refurbishment, ensuring that remanufactured motors meet or exceed original performance standards. For example, the use of IoT-enabled sensors allows real-time data collection during both the remanufacturing process and subsequent operation, supporting continuous improvement and reliability tracking (ABB).

Another notable development is the integration of automation and robotics into remanufacturing workflows. Automated disassembly, cleaning, and reassembly processes are reducing human error and increasing throughput. Robotics also facilitate the handling of complex or hazardous tasks, improving worker safety and consistency in quality. This automation aligns with the broader trend of smart factories, where remanufactured motors are expected to seamlessly interface with Industry 4.0 systems (Siemens).

Material innovation is also influencing remanufactured electric motor systems. The use of advanced insulation materials, high-efficiency bearings, and improved winding techniques is enhancing the energy efficiency and lifespan of remanufactured units. These improvements are critical as industries seek to comply with stricter energy regulations and sustainability goals (International Energy Agency).

Digital twin technology is emerging as a transformative tool in the remanufacturing sector. By creating a virtual replica of the motor, engineers can simulate performance, predict failures, and optimize maintenance schedules. This approach not only improves the reliability of remanufactured motors but also supports integration with predictive maintenance systems in automated industrial settings (GE).

Finally, the adoption of standardized remanufacturing protocols and certification schemes is gaining momentum. These standards ensure interoperability, traceability, and quality assurance, which are essential for widespread acceptance of remanufactured electric motors in mission-critical automation applications (International Organization for Standardization).

Competitive Landscape and Leading Players

The competitive landscape for remanufactured electric motor systems in industrial automation is characterized by a mix of established OEMs, specialized remanufacturers, and third-party service providers. As of 2025, the market is witnessing intensified competition driven by the growing demand for cost-effective, sustainable solutions and the increasing adoption of circular economy principles in manufacturing sectors.

Key players in this space include global automation and motor manufacturers such as ABB, Siemens, and Schneider Electric, all of which have expanded their remanufacturing and refurbishment services to address customer needs for reliable, lower-cost alternatives to new equipment. These companies leverage their extensive service networks, proprietary technologies, and access to original parts to ensure high-quality remanufactured products that meet or exceed OEM standards.

Specialized remanufacturers, such as Integrated Power Services (IPS) and EuroRotor, focus exclusively on electric motor and drive system remanufacturing. They differentiate themselves through rapid turnaround times, advanced diagnostic capabilities, and tailored service agreements for industrial clients. These firms often collaborate with OEMs or operate as authorized service providers, further enhancing their credibility and market reach.

Third-party service providers and regional players, including Motion Industries and Regal Rexnord, also play a significant role, particularly in North America and Europe. They offer remanufactured motors as part of broader maintenance, repair, and operations (MRO) portfolios, appealing to customers seeking integrated solutions and local support.

- Market Share: According to MarketsandMarkets, the top five players collectively account for over 40% of the global remanufactured electric motor systems market in 2025, with the remainder fragmented among regional and niche providers.

- Strategic Initiatives: Leading companies are investing in digital platforms for asset tracking, predictive maintenance, and remote diagnostics to enhance service offerings and customer retention.

- Barriers to Entry: High technical expertise, access to original parts, and compliance with stringent industrial standards remain key barriers, favoring established players with robust R&D and service infrastructures.

Overall, the competitive landscape is expected to remain dynamic, with consolidation likely as larger players seek to expand their remanufacturing capabilities and geographic presence through acquisitions and partnerships.

Market Size & Growth Forecasts (2025–2030): CAGR and Revenue Projections

The global market for remanufactured electric motor systems in industrial automation is poised for robust expansion between 2025 and 2030, driven by increasing demand for cost-effective, sustainable solutions in manufacturing and process industries. According to recent analyses, the market is projected to reach a valuation of approximately USD 4.2 billion by 2025, with expectations to surpass USD 6.8 billion by 2030. This reflects a compound annual growth rate (CAGR) of around 10.1% during the forecast period MarketsandMarkets.

Several factors underpin this growth trajectory. First, the rising adoption of circular economy principles and stringent environmental regulations are compelling industries to opt for remanufactured electric motors, which offer significant reductions in energy consumption and raw material usage compared to new units. Second, the ongoing modernization of industrial automation infrastructure—particularly in sectors such as automotive, food & beverage, and chemicals—is fueling demand for reliable, cost-efficient motor systems that can be rapidly deployed with minimal downtime Grand View Research.

Regionally, Asia-Pacific is expected to dominate the market, accounting for over 40% of global revenue by 2025, propelled by large-scale industrialization in China, India, and Southeast Asia. North America and Europe are also significant contributors, benefiting from established remanufacturing ecosystems and supportive policy frameworks Fortune Business Insights.

- 2025 Market Size: USD 4.2 billion

- 2030 Market Size (Projected): USD 6.8 billion

- CAGR (2025–2030): 10.1%

- Key Growth Drivers: Sustainability mandates, cost savings, rapid industrial automation, and regulatory support

- Leading Regions: Asia-Pacific, North America, Europe

In summary, the remanufactured electric motor systems market for industrial automation is set for sustained double-digit growth through 2030, underpinned by both economic and environmental imperatives. Market participants are expected to benefit from expanding opportunities in emerging economies and ongoing technological advancements in remanufacturing processes.

Regional Analysis: Demand Hotspots and Emerging Markets

The global market for remanufactured electric motor systems in industrial automation is experiencing dynamic regional shifts, with demand hotspots emerging in both established and developing economies. In 2025, North America and Western Europe continue to lead in adoption, driven by stringent environmental regulations, mature industrial bases, and a strong focus on cost optimization. The United States, in particular, benefits from robust industrial automation sectors in automotive, food processing, and packaging, with remanufactured solutions gaining traction due to their lower lifecycle costs and sustainability benefits. According to Grand View Research, the North American remanufactured electric motor market is projected to grow steadily, supported by government incentives for circular economy initiatives and increasing end-user awareness.

In Western Europe, Germany, France, and the UK are at the forefront, leveraging advanced manufacturing ecosystems and aggressive decarbonization targets. The European Union’s Green Deal and circular economy action plan are catalyzing investments in remanufacturing infrastructure, making the region a key demand hotspot. Statista reports that the European remanufactured industrial equipment market is expected to see a compound annual growth rate (CAGR) of over 7% through 2025, with electric motors representing a significant share.

Asia-Pacific is rapidly emerging as a critical growth engine, particularly in China, India, and Southeast Asia. China’s industrial modernization and the government’s push for resource efficiency are driving adoption of remanufactured electric motors, especially among small and medium-sized enterprises seeking affordable automation upgrades. India’s “Make in India” initiative and rising energy costs are also prompting manufacturers to consider remanufactured systems as a cost-effective alternative to new equipment. Mordor Intelligence highlights that the Asia-Pacific region is expected to register the fastest growth rate globally, with local remanufacturers expanding capacity to meet surging demand.

- Latin America: Brazil and Mexico are seeing increased uptake, particularly in automotive and food processing sectors, as companies seek to extend asset lifecycles and reduce capital expenditures.

- Middle East & Africa: While still nascent, the market is gaining momentum in the Gulf Cooperation Council (GCC) countries, where industrial diversification and sustainability mandates are encouraging remanufacturing adoption.

Overall, 2025 will see remanufactured electric motor systems for industrial automation gaining ground in both mature and emerging markets, with regional growth patterns shaped by regulatory frameworks, industrial maturity, and sustainability imperatives.

Challenges, Risks, and Regulatory Considerations

The adoption of remanufactured electric motor systems in industrial automation presents a range of challenges, risks, and regulatory considerations that stakeholders must navigate in 2025. One of the primary challenges is ensuring consistent quality and performance standards. Remanufactured motors, by definition, involve the refurbishment and reuse of existing components, which can introduce variability in reliability and lifespan compared to new units. This variability can be a significant concern for industries with critical uptime requirements, such as manufacturing and process automation, where unexpected failures can lead to costly downtime (International Energy Agency).

Another key risk is the potential for supply chain disruptions. The remanufacturing process depends on the availability of used motors and components, which can be affected by fluctuations in industrial activity, changes in equipment design, and evolving end-of-life management practices. Additionally, the global nature of supply chains exposes remanufacturers to geopolitical risks, trade restrictions, and logistical challenges, all of which can impact lead times and cost structures (Gartner).

Regulatory considerations are increasingly complex. In 2025, environmental regulations governing waste reduction, recycling, and energy efficiency are tightening in major markets such as the European Union, North America, and parts of Asia. Remanufacturers must comply with directives like the EU’s Ecodesign and Waste Electrical and Electronic Equipment (WEEE) regulations, which set stringent requirements for product labeling, documentation, and end-of-life management (European Commission). Non-compliance can result in fines, product recalls, or market access restrictions.

Intellectual property (IP) risks also arise, particularly when remanufacturing involves proprietary technologies or software embedded in modern electric motor systems. Unauthorized use or reverse engineering of patented components can lead to legal disputes with original equipment manufacturers (OEMs), potentially stifling market growth (World Intellectual Property Organization).

Finally, there is a reputational risk for both remanufacturers and end-users. If remanufactured motors fail to meet performance expectations or are perceived as inferior, it can undermine confidence in the circular economy model and slow adoption rates. To mitigate these risks, industry players are increasingly investing in advanced testing, certification, and traceability solutions, as well as collaborating with regulatory bodies to establish clear standards for remanufactured electric motor systems (UL Solutions).

Opportunities and Strategic Recommendations

The market for remanufactured electric motor systems in industrial automation is poised for significant growth in 2025, driven by increasing demand for cost-effective, sustainable solutions and the rapid pace of industrial digitalization. Several key opportunities and strategic recommendations can be identified for stakeholders aiming to capitalize on this evolving landscape.

- Expansion into Emerging Markets: Industrial automation is accelerating in regions such as Southeast Asia, Latin America, and Eastern Europe, where cost sensitivity is high and infrastructure modernization is ongoing. Remanufactured electric motors offer a compelling value proposition in these markets, combining lower upfront costs with reliable performance. Companies should consider establishing local remanufacturing facilities or partnerships to reduce logistics costs and improve market responsiveness (ABB).

- Integration with Industry 4.0 Solutions: There is a growing trend toward integrating remanufactured motors with smart sensors and IoT platforms, enabling predictive maintenance and real-time performance monitoring. This not only extends the lifecycle of remanufactured systems but also aligns with the digital transformation goals of industrial clients. Strategic investments in digital retrofitting and data analytics capabilities can differentiate offerings in a competitive market (Siemens).

- Emphasis on Sustainability and Circular Economy: As regulatory pressures and corporate sustainability goals intensify, remanufactured electric motors are increasingly favored for their reduced environmental footprint. Companies should highlight lifecycle assessments and certifications to appeal to environmentally conscious buyers and comply with evolving standards such as the EU’s Ecodesign Directive (International Energy Agency).

- Service-Based Business Models: Offering remanufactured motors as part of service contracts—such as leasing, maintenance-as-a-service, or performance-based agreements—can create recurring revenue streams and foster long-term customer relationships. This approach also addresses concerns about reliability and support, which are critical for industrial automation clients (GE).

- Strategic Alliances and Certification Programs: Collaborating with OEMs, automation integrators, and industry associations can enhance credibility and market reach. Participation in recognized certification programs for remanufactured products can further assure quality and compliance, reducing buyer hesitation (Remanufacturing Industry Council).

In summary, the remanufactured electric motor systems market in industrial automation presents robust opportunities in 2025 for companies that prioritize digital integration, sustainability, and innovative service models. Strategic investments in these areas will be key to capturing market share and driving long-term growth.

Future Outlook: Innovation, Adoption, and Market Evolution

The future outlook for remanufactured electric motor systems in industrial automation is shaped by accelerating innovation, increasing adoption rates, and evolving market dynamics through 2025. As industries intensify their focus on sustainability and cost efficiency, remanufactured electric motors are gaining traction as a viable alternative to new units, particularly in sectors such as manufacturing, logistics, and process industries.

Innovation is a key driver in this segment. Advanced diagnostic tools, digital twin technology, and predictive maintenance solutions are being integrated into remanufacturing processes, enhancing the reliability and performance of remanufactured motors. Companies are leveraging Industry 4.0 principles to streamline remanufacturing workflows, reduce turnaround times, and ensure that remanufactured motors meet or exceed original equipment manufacturer (OEM) specifications. For example, the adoption of AI-driven quality control and automated testing is expected to further improve product consistency and traceability, addressing historical concerns about remanufactured product quality (Siemens).

Adoption is poised to accelerate as end-users recognize the dual benefits of cost savings and environmental impact reduction. According to ABB, remanufactured electric motors can offer up to 40% cost savings compared to new units, while also reducing raw material consumption and carbon emissions. Regulatory pressures, such as the European Union’s Circular Economy Action Plan, are encouraging manufacturers to prioritize remanufacturing and reuse, further boosting market demand (European Commission). Additionally, large industrial players are increasingly incorporating remanufactured motors into their asset management strategies to extend equipment lifecycles and minimize downtime.

- Market evolution is expected to see a shift toward service-based models, with OEMs and third-party providers offering remanufacturing as part of comprehensive maintenance contracts.

- Emerging markets in Asia-Pacific and Latin America are projected to experience the fastest growth, driven by expanding industrial bases and rising awareness of circular economy principles (MarketsandMarkets).

- Collaborations between OEMs, remanufacturers, and technology providers are likely to intensify, fostering standardization and best practices across the industry.

By 2025, the remanufactured electric motor systems market is expected to be characterized by greater technological sophistication, broader acceptance across industries, and a more robust regulatory framework, positioning it as a cornerstone of sustainable industrial automation.

Sources & References

- International Energy Agency

- MarketsandMarkets

- ABB

- Siemens

- Electrical Apparatus Service Association (EASA)

- European Commission

- Grand View Research

- European Medicines Agency

- Rematec

- GE

- Fortune Business Insights

- Statista

- Mordor Intelligence

- European Commission

- World Intellectual Property Organization

- UL Solutions